Banking Customer

Online Security

When surfing the internet, you must always remember the precautions you should take to ensure the security of the operations carried out, safeguard your personal data and thus minimise the risks of misuse by third parties.

Find out here about some essential security rules to adopt when using your computer, mobile phone or tablet to access your bank and carry out transactions such as online purchases or banking operations.

Types of Fraud

Cyber-attacks are based on increasingly sophisticated tactics that are difficult to detect. Cybercriminals' tactics range from pretending to be the CEO of a company to trying to lure you into a romantic relationship. They’ll do whatever it takes to access your personal data or steal your money. A single click can be enough to compromise an entire company. Knowing how to identify the types of fraud that exist online is, therefore, a fundamental step towards being more protected. Find out about the most common #Cyberscams here, in an initiative promoted by Europol and the European Banking Federation (EBF), with the support of the Portuguese Banking Association.

See also the 'Banking and Internet - Prevention' guide prepared by the Portuguese Banking Association (APB), and learn some rules for safe internet use.

How to be careful

Are you going to buy online using a payment card? Learn how to stay secure

Strong Authentication

As is already the case with online access to bank accounts, since 31 December 2020, banks/payment service providers must request strong authentication from their customers whenever they make online purchases using a card.

When using strong authentication, banks/payment service providers ask the customer for two or more elements belonging to the categories of "knowledge" (e.g. password), "possession" (e.g. code sent by SMS to the mobile phone, thus proving ownership of the device), and "inherence" (a feature that identifies the user, such as the fingerprint).

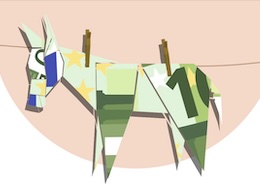

Money Mulling

More than 90% of the "Money Muling" transactions identified in Europe are related to cybercrime. The money often originates from criminal activities such as phishing, malware attacks, online purchase or payment fraud, romance scams, etc.

What is Money Muling?

Money Muling is a form of money laundering. A "Money Mule" is someone who receives money from a person or entity into their bank account and transfers it to another account or withdraws it and gives it to a third person or entity, obtaining a benefit in return.

Even if the "Money Mules" are not directly involved in the crimes that result in obtaining the money (cybercrime, online fraud and payments, drugs, human trafficking, etc.), they are accomplices, since they have collaborated in "laundering" those funds. In other words, Money Mules help criminal networks remain anonymous while transferring money around the world.

If you think you are being used as a "mule" act now before it is too late: stop transferring money and inform your bank or the police immediately.

Please consult the Europol website for more information