In 2024, the banking sector strengthened its profitability and improved asset quality while liquidity remained robust and capital reached historically high levels.

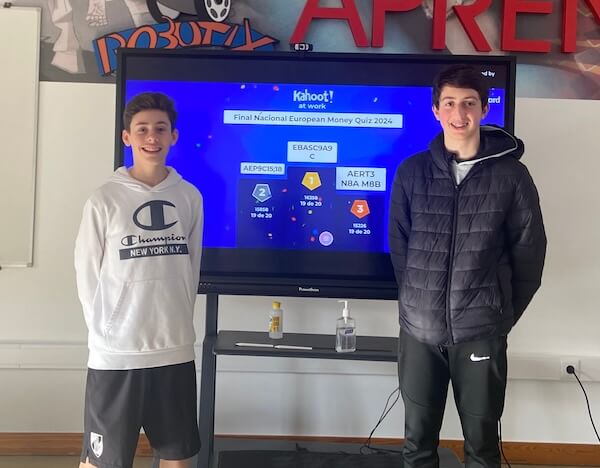

The Portuguese Banking Association (APB) marks World Investor Week by hosting a Banking Open Day, featuring two financial literacy initiatives aimed at around 150 young people: a session on online security and a visit to the "AI Innovation Garden" exhibition in Lisbon.

This year, the Portuguese Banking Association (APB) celebrates 40 years of activity. Over these four decades, the sector has faced numerous challenges, affirming its indispensable and irreplaceable role in society.

What's New

Publications

Banking Sector

at a Glance

Get an overview of the main indicators of the Portuguese banking sector regarding its performance and its importance in supporting the economy, particularly in terms of size, credit, deposits, interest rates, liquidity, profitability, solvency and asset quality.

Topics

Get a comprehensive overview of the key areas that shape the banking sector, such as supervision, regulation, financial markets, and payments, among other key issues for the development of the financial system.

Multimedia

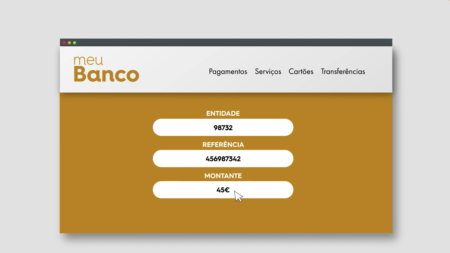

Saber de Contas is a financial literacy website developed by the APB that will help you better understand some banking and financial topics related to family budget management, credit, savings, investment, payments, and online security.

The IFB carries out training focused on the profiles and skills needed to perform banking roles, with a range that seeks to respond to both ongoing and emerging challenges in the financial sector.

Members

The 28 members constitute more than 90% of the assets of the Portuguese banking system.